In the world of freelancing, there is a universal rule – never miss a pay day. What this means is that when you work for a foreign organization, on the pay date, you are meant to withdraw your earnings to avoid any sort of wahala. Many people get into several complications and as a result, lose the earnings for their hard work. Some companies pay biweekly, and others pay at the end of the month. Sometimes, it may be on fixed days, but one universal rule applies, and it is that you must place a withdrawal immediately when you are paid. Many of these companies have different channels for payment, but the most popular of these is Payoneer. So, what role does Grey play in this discussion?

As a freelancer, you are meant to have a verified Payoneer account because this is the first stage through which you will receive your payment. You can decide to link your Payoneer account to your local bank or you can decide to make use of other channels to receive your money, and this is where Grey comes in.

You see, your local bank buys your dollar at a very cheap rate and sells it to you at a higher rate. For instance, if you send $50 to your local bank directly from Payoneer, you may receive N65,000 at the rate of N1,300/$. On the flip side, we have intermediaries like Cleva, Grey, Geegpay, and a host of others who buy your dollar at a higher price compared to your local bank. This means, if your local bank offers N1,300/$, Grey may offer N1,390/$. Let’s take a look at this example:

Mr A withdraws $100 from his Payoneer account to his local bank and receives a total sum of N130,000. Mr B on the other hand decides to transfer $100 to his Grey account. When the money gets into Grey, he places his withdrawal and is sent N139,000. Both men placed a withdrawal of $100, but the value of what they got was miles apart. Now, I need you to think. If each man withdrew $1,000, who would run at a loss, Mr A or Mr B? Yes, you read my mind just right.

OPENING A PAYONEER ACCOUNT

Opening a Payoneer account is fairly easy.

Step 1: CLICK HERE to open a Payoneer account if you do not have one yet. When the page opens, click on “Join now and earn $250” and you’ll be taken to the next screen:

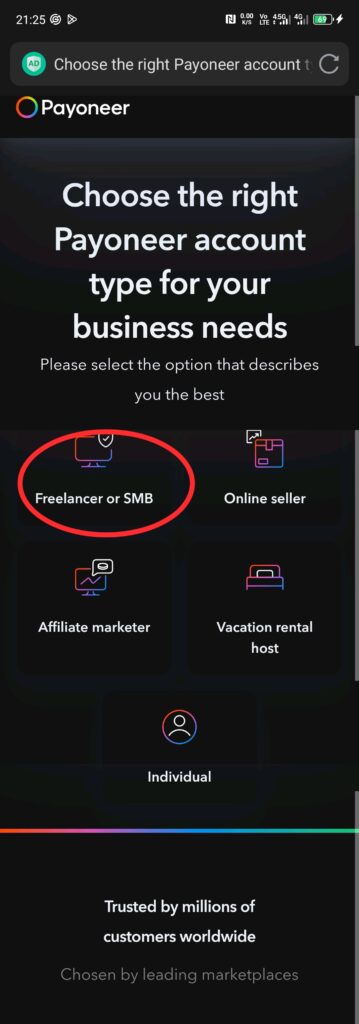

Step 2: When asked to choose the type of Payoneer account you intend to open, click on Freelancer or SMB.

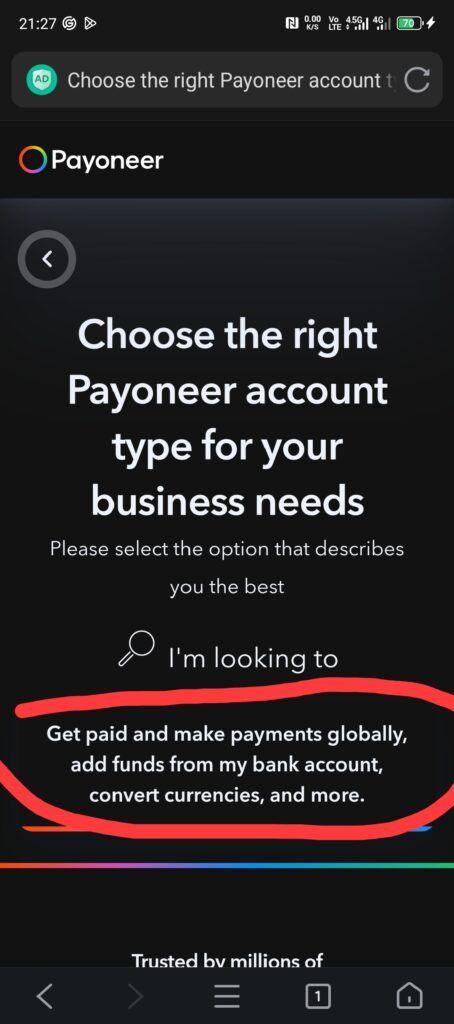

Step 3: Tap on the “Get paid and make payments globally…”

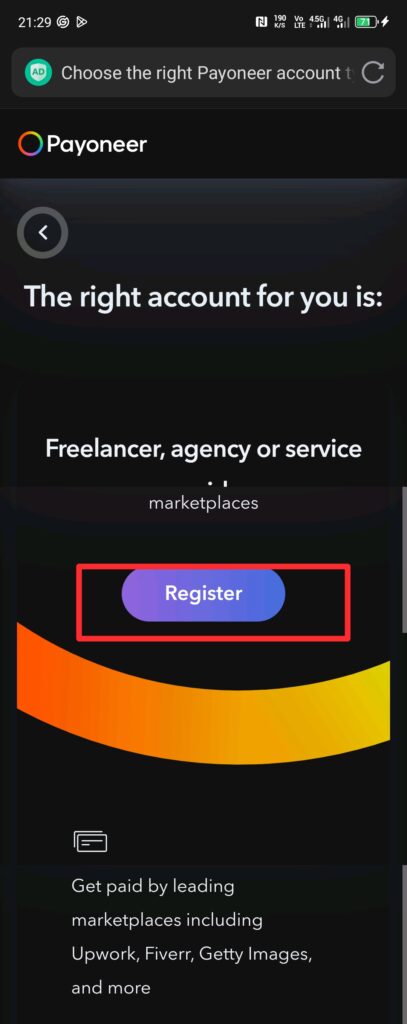

Step 4: Click on “register”

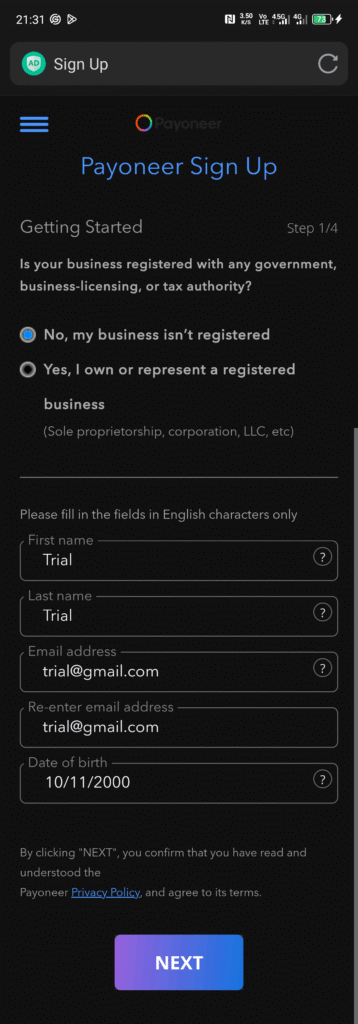

Now, this is where the final phase of the registration comes in. You will be taken to the next page where you have to fill in your personal details. You will typically see a form like this in the image below:

First mark the option that states your business is not registered, then click on “NEXT”. In the next page, you are to put in your local bank details, your home address, phone number, and other important details. You will also have to upload a physical hard copy of a valid means of identification. If you only have an NIN slip, it will not be accepted for registration. It has to be in the form of an ID card.

Now once you create a Payoneer account, you are ready to receive payments from any company paying in dollars.

OPENING A GREY ACCOUNT

Opening a Grey account is fairly easy and straight to the point. To open a Grey account, go to Google Play Store if you are an android user / if you are an iPhone user, visit the App Store to install the Grey app. Click on register and when asked for a referral code, type in RNHYHE to receive free $5 from Grey. It is easy to apply and you can easily create a USD account upon registration.

When you have done this, you are ready for the next challenge.

As always, be sure to share this post to your friends and family members who are in need of jobs. I’ll be here to hold your hand and guide you through every step of your journey to making your first $1,000 from the internet. Till we meet again in the next article, THANK YOU for reading through!